Austeritatea a distrus Grecia în așa măsură încât până și pentru cei de la Financial Times lucrurile arată foarte rău.

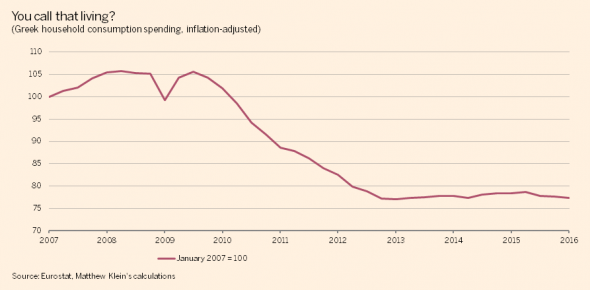

The collapse of the Greek economy is almost without precedent. Real household consumption has dropped by 27 per cent since the peak. During the global financial crisis, this figure “only” fell by 6 per cent before rebounding:

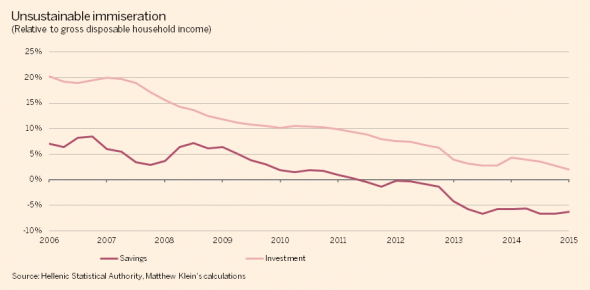

The combination of mass joblessness, wage cuts, and higher taxes means disposable household incomes have fallen even further. To make up the difference, Greeks have been eating into their savings. In 2006-2009, the personal savings rate averaged about 6 per cent. In 2015, the rate was -6 per cent.

The total amount of dis-saving since mid-2011 implies Greek households have eaten into €19bn worth of savings even as their living standards have cratered. For comparison, the financial accounts published by the Bank of Greece indicate €36bn in household bank deposits and cash, including deposits in non-Greek banks and foreign currency, disappeared over the same period:

Greek households have cut their investment spending even further, from about a fifth of disposable income in 2007 to just 2 per cent in 2015. The gap between gross savings and gross investment is somewhat narrower now (about 9 per cent of disposable income) than before the crisis (13 per cent), but the behaviour necessary to generate this gap is far less sustainable:

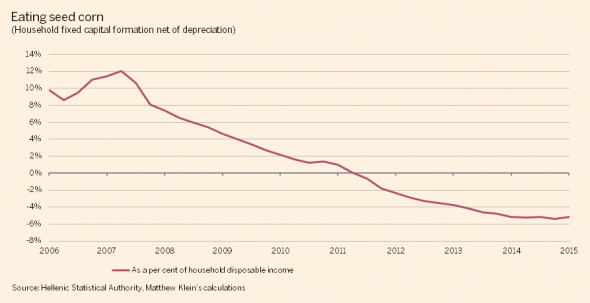

Moreover, this investment spending is far too low to offset depreciation. After accounting for wear and tear, Greek household spending on housing, cars, etc is now running at a rate of -5 per cent of household incomes:

Continuarea aici

Continuarea aici